The South African commercial vehicle market recorded a decline in sales during April, lagging 7.5% behind the year-to-date results of 2017. A total of 7 674 new trucks and buses have so far been sold in 2018.

This is according to the latest results released by the National Association of Automobile Manufacturers of South Africa (Naamsa), Associated Motor Holdings (AMH) and Amalgamated Automobile Distributors (AAD).

April’s sales of 1 838 units was also a significant 22.1% down on March 2018’s results. According to Gert Swanepoel, managing director of UD Trucks Southern Africa, April is traditionally the start of an upturn in annual sales, but this year’s results are disappointing.

“A number of factors are currently hampering sales, including the recent violent attacks on trucks on our roads, which definitely hampers business confidence in the market,” said Swanepoel. “Countrywide industry strikes and the number of public holidays during April also weren’t very conducive to create a positive buying environment for fleets.

It wasn’t all bad news, as sales in the Extra Heavy Commercial Vehicle segment increased by 8.1% to 956 units when compared to April 2017’s results. However, Medium Commercial Vehicle sales were down by 12.1% to 493 units, and Heavy Commercial Vehicles declined by 8.5% to 333 units in this month-by-month comparison. A decline in Bus sales was expected, as this segment recorded a significant 30% decline in sales to only 56 units sold during April.

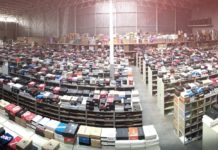

On the positive side, Swanepoel said that a developing trend within the truck market is the larger portion of sales that go to online shopping businesses.

“Our online retailer customer base has grown with leaps and bounds over the past few years, as more and more South Africans turn to the Internet to do their shopping,” said Swanepoel. “We have found that these emerging fleet owners have a passion for the transport business and are focussed on fuel efficiency, productivity and operating costs.”

Swanepoel said that these innovative companies are slowly challenging the more traditional transport industry to be more flexible, approachable and precise as customers demand a faster and more reliable service for the timely delivery of their online purchases.

“Over recent months we have also seen that many government contracts are being awarded to up-and-coming companies, rather than more established traditional fleets, which has also changed the DNA of the industry,” said Swanepoel. “We believe that these developing trends will continue to push the industry as a whole to adapt, to be more innovative and to deliver products and services that the world needs today, and into the future.”